AngelCopilot: a copilot for angel investing

AngelCopilot is an assistant I built to give more structure to my angel investing. It started from a carefully curated prompt, and I turned it into a custom GPT so that others can use it as well. I’m sharing it publicly in case it’s useful to others who want a more repeatable way to evaluate deals. You can access it here.

AngelCopilot doesn’t replace judgment or experience. It does something simpler and more practical:

helps you reason about how much to allocate to angel investing,

keeps a reusable investor profile,

and evaluates individual deals with a structured rubric.

What AngelCopilot does

At a high level, AngelCopilot is an educational assistant for angel investors. It won’t tell you what to invest in. It helps you think more systematically about three aspects.

1. Allocation and check sizing

AngelCopilot asks for basic information about your investing situation and goals:

approximate net worth and investable capital

cash buffer (months of expenses)

existing investments (ETFs, property, etc.)

time horizon and risk comfort

It then applies a simple allocation heuristic (cash buffer → core portfolio → angel budget + follow-on reserve), to produce an illustrative plan, such as:

“Given your profile, an 8% angel allocation over 10 years implies about €X/year,

which supports ~N new deals at €Y per initial check, plus a follow on reserve.”

In other words, it helps you make informed decisions into your angel investing strategy.

2. A reusable investor profile

AngelCopilot stores your preferences in a structured profile:

region, currency

net worth & investable capital

buffer months & time horizon

inferred risk level (low / medium / high)

ticket min / typical / max

follow-on ratio

sectors/themes & geo focus

desired involvement (hands-on vs. passive)

At the end of the onboarding, it prints this profile as a simple text block:

### AngelCopilot Profile (Copy and keep)

region: [...]

currency: [...]

net_worth: [...]

investable_estimate: [...]

buffer_months: [...]

horizon_years: [...]

inferred_risk_level: [...]

ticket_min/typical/max: [...]

follow_on_ratio: [...]

themes: [...]

geo_focus: [...]

involvement_preference: [...]You can save that in Notes / Notion / wherever. Any time you start a new chat, you paste it and AngelCopilot reloads your profile. This ensures that the deal assessments that you get are tailored to your situation.

Some useful commands related to your investor profile:

“Create or load my investor profile” – start or reload

“Save my profile” – reprint the latest profile block

“Show my profile” – see what’s currently active

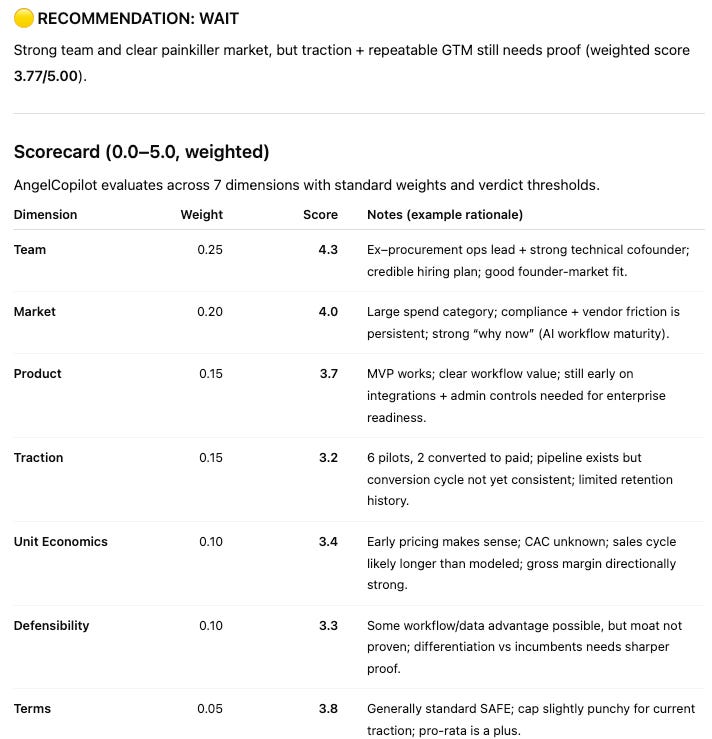

3. Deal assessment with a 7-factor rubric

For evaluating deals, AngelCopilot uses a 7-factor rubric based on:

Team

Market

Product

Traction

Unit Economics

Defensibility

Terms

Each factor is scored from 0–5 and has a fixed weight (Team and Market carry more weight than, say, Terms). The output includes:

a weighted average score

a banner verdict: 🟢 INVEST / 🟡 WAIT / 🔴 PASS

a pessimistic / base / optimistic return table (multiples, IRR, rough probabilities)

key risks and unknowns

milestones to watch before increasing your exposure

You can also ask it to factor in fees or carry if you’re investing via syndicates or funds.

Before scoring, AngelCopilot does a web sweep (company website, recent news, founders’ background, customers, competitors, reviews, basic regulatory/IP signals where relevant) and reconciles that with any documents you upload. If something doesn’t line up, it flags it.

The foundations for the Rubric

AngelCopilot’s deal rubric is not invented from scratch. It’s inspired by the Scorecard Valuation Methodology developed by angel educator Bill Payne, which uses a 7-factor weighted scorecard (30% team, 25% market, 15% product/technology, and the remainder across competition, go-to-market, and other factors).¹ Angel education material such as the Angel Resource Institute – Scorecard to Evaluate the Deal and university workshops (CMU Swartz Center, Equidam/Scorecard Method) apply the same structure and weights when teaching investors how to evaluate early-stage deals [3,4].

Academic work on angel decision-making shows that angels consistently prioritize management team, market opportunity, and competitive advantage in their formal scorecards and screening processes, ahead of purely financial metrics [5, 6]. AngelCopilot encodes these same dimensions—Team, Market, Product, Traction, Unit Economics, Defensibility, and Terms—into a transparent, educational rubric with weights that put the most emphasis on people and market, while still assessing traction, economics, and terms explicitly.

How to use AngelCopilot in practice

There are three simple flows.

1. Set up (or reload) your profile

Start with:

“Create or load my investor profile.”

If you already have a saved profile block, paste it. AngelCopilot parses and confirms it.

If you’re new, say “Start onboarding” and answer a small set of questions about:

country / currency

net worth and investable capital

cash buffer and expected big expenses

risk comfort

sectors/themes, ticket size, follow-on strategy

At the end, copy the profile block and save it somewhere you control.

2. Sanity-check your allocation

Once a profile is loaded, ask:

“Suggest my investment allocation.”

You’ll get an educational breakdown of:

approximate cash buffer in months and €

core / long-term allocation

an angel bucket over your horizon

approximate number of deals / year and suggested check size

implied follow-on reserve

You can iterate:

“Be more conservative / aggressive.”

“Re-run assuming my typical check is €X–Y.”

“Take into account that I already invested €Z this year.”

The goal is not to optimise to the last euro, but to make sure your angel activity fits inside a coherent plan. If you already have in mind an investment allocation, you can skip this step.

3. Assess a specific startup deal

When you have a concrete deal, use:

“Assess a startup deal.”

And either:

Upload documents (deck, memo, one-pager, etc.), or

say “I’ll fill it in manually” and answer structured questions.

You’ll get a memo-like output with:

company & round summary

7-factor scorecard and weighted score

🟢 INVEST / 🟡 WAIT / 🔴 PASS verdict

return scenarios (pessimistic / base / optimistic)

key risks and questions

milestones to watch

You can then ask for follow up questions, such as:

Do a deeper competitor sweep: who are the top 5 competitors, how do they position, and what are their pricing and target customers?

Which competitors already offer the features the deck claims are unique?

“What are the top 5 missing pieces of evidence that would reduce uncertainty here?”

Think of it as a way to standardise your notes and make deals comparable over time.

Data & privacy

A common (and fair) question is: “What happens to the data I upload?”

For AngelCopilot specifically, I have turned off the setting: “Use conversation data in your GPT to improve our models”. This means:

conversations and documents you use with AngelCopilot are not used to train OpenAI’s models

they are only used to power your current ChatGPT session (and are handled under OpenAI’s standard privacy and security terms).

Figure: Storing conversational data into the AngelCopilot is turned off.

That said, a few practical guidelines:

Only upload documents you are allowed to share and are comfortable having processed by ChatGPT.

If you’re uneasy about uploading full decks or financial models, you can:

strip out sensitive details,

or summarise key points and paste them manually instead.

You can always choose the manual input route and avoid file uploads entirely.

AngelCopilot will work with as much or as little detail as you give it — the trade-off is simply how granular the analysis can be.

Evaluation

This is not a full-blown backtest, but I wanted a basic sanity check before sharing AngelCopilot. For this check I made a simple working assumption: deals that are harder to access are, on average, higher quality. Concretely, I treated invite-only, curated syndicate deals as Tier A, and deals from open angel platforms with very low entry barriers as Tier B.

This isn’t perfect, but it’s also not arbitrary. A large body of work shows that portfolio companies backed by higher-reputation venture investors tend to have better outcomes on average – for example, higher exit rates and stronger post-IPO performance [7, 8, 9]. At the same time, top-performing VC funds exhibit performance persistence and are often oversubscribed, effectively restricting access to a relatively small set of preferred LPs [10, 11]. Taken together, this provides reasonable empirical support for the idea that curated, hard-to-access deal flow is more likely to contain “better” deals, even though any individual deal can of course still fail.

The evaluation methodology:

I took a set of Tier A deals from a hard-to-access syndicate (the kind of opportunities that usually require strong networks and are curated by experienced leads).

I took a set of Tier B deals from more open angel investing websites with low entry barriers.

I ran both sets through AngelCopilot using the same rubric and default weights, without giving it any information about where the deals came from, to keep the evaluation as unbiased as possible.

What I found:

Tier A deals consistently scored higher than Tier B deals under the default rubric.

The gap was large enough that, in an independent two-sample t-test (

scipy.stats.ttest_ind), the Tier A and Tier B distributions differed significantly (p < 0.05). In practical terms: if you looked only at the outputs, you’d broadly prefer the Tier A basket over Tier B.

This is not a claim that AngelCopilot can pick winners ex-ante, and it’s obviously not a substitute for realised 10-year outcomes. But it’s a useful sanity check that the rubric is not behaving randomly and it broadly aligns with an external “this looks harder to access / more curated” signal.

I’ll share a more technical write-up of AngelCopilot’s development and evaluation in a future Beyond the Demo article for those who want to dig into the technical details.

How not to use AngelCopilot

A few guardrails:

AngelCopilot is not:

a financial advisor

a shortcut to avoid talking to founders

or a way to outsource conviction

You shouldn’t:

blindly follow any 🟢 INVEST verdict

skip your own due diligence

use it as automatic approval for a decision you’re not willing to question anymore

The best use I’ve found is:

as a thinking partner that surfaces blind spots

as a way to document your reasoning at the time of investment

and as a consistent lens across multiple deals so you don’t move the goalposts every week.

The final yes/no is still yours.

Closing note

AngelCopilot is an experiment in making angel investing a bit more structured and a bit less ad-hoc. If you try it I’d be happy to hear where it helps, where it gets in the way, and what you’d want it to do differently. If you find it useful, please share it with founders, angel investors and anyone that may benefit from it.

Disclaimer: AngelCopilot is an educational tool. It does not provide financial, legal, or tax advice, and nothing it produces should be taken as a recommendation to buy or sell any security. Always conduct your own due diligence before making investment decisions.

References

Payne, B. (2021). Scorecard valuation methodology [PDF]. SeedSpot. https://seedspot.org/wp-content/uploads/2021/02/Scorecard-Valuation-Methodology.pdf

Angel Capital Association. (2019). Scorecard to evaluate the deal (Scorecard valuation methodology, Rev. 2019) [Blog post]. https://angelcapitalassociation.org/blog/blog-scorecard-valuation-methodology-rev-2019-establishing-the-valuation-of-pre-revenue-start-up-companies/

Carnegie Mellon University, Swartz Center for Entrepreneurship. (2019). Role of angel investors in capital formation [PDF]. https://www.cmu.edu/swartz-center-for-entrepreneurship/assets/connects-spring-2022/angel-investor-landscape_cmu-12-04-19.pdf

Equidam. (2025). Understanding Equidam valuation: Methodology [PDF]. https://www.equidam.com/resources/Equidam-Valuation-Methodology.pdf

Sudek, R. (2006). Angel investment criteria. Journal of Small Business Strategy, 17(2), 89–104. https://jsbs.scholasticahq.com/article/26530.pdf

Galbraith, C. S., DeNoble, A. F., & Ehrlich, S. B. (2009). The use and content of formal rating systems in angel group investment initial screening stages. Journal of Small Business Strategy, 20(2), 61–79. https://libjournals.mtsu.edu/index.php/jsbs/article/view/128

Krishnan, C. N. V., Ivanov, V. I., Masulis, R. W., & Singh, A. K. (2011). Venture capital reputation, post-IPO performance, and corporate governance. Journal of Financial and Quantitative Analysis, 46(5), 1295–1333. https://doi.org/10.1017/S0022109011000251

Lin, R., Li, Y., Peng, T., & Zhang, H. (2017). Venture capital reputation and portfolio firm performance in an emerging economy: The moderating effect of institutions. Asia Pacific Journal of Management, 34(3), 699–723. https://doi.org/10.1007/s10490-016-9500-1

Lappi, L., & Laurikainen, J. (2023). Does VC investor reputation matter? An analysis of portfolio company success in Europe (Master’s thesis, Aalto University School of Business). https://aaltodoc.aalto.fi/items/40bb736d-0198-483d-a3cc-d5d224e7cd85

Harris, R. S., Jenkinson, T., Kaplan, S. N., & Stucke, R. (2023). Has persistence persisted in private equity? Evidence from buyout and venture capital funds. Journal of Corporate Finance, 81, 102361. https://doi.org/10.1016/j.jcorpfin.2023.102361

Sensoy, B. A., Wang, Y., & Weisbach, M. S. (2014). Limited partner performance and the maturing of the private equity industry. Journal of Financial Economics, 112(3), 320–343. https://doi.org/10.1016/j.jfineco.2014.02.006